Compliance Stay legally safe with every transaction

The requirement for compliance extends beyond merchants because it safeguards your consumer rights to obtain refunds and warranties and proof of purchase during critical situations.

The fiskaltrust system validates all received receipts for legal purposes while making them accessible for tax purposes and refund or reimbursement processing.

Your data remains under your control while you select receipt delivery methods without needing to download an app or create an account.

The technology operates in more than 100,000 European merchant locations throughout the continent.

The system operates identically when you purchase food in Vienna or clothing in Milan. The system protects your personal information from disclosure. You can choose to share data when you want to earn loyalty points or store digital guarantee cards or wallet app receipts. The system will remain invisible to you when you choose not to share data.

Receipts should function as described for the year 2025. The system provides basic digital receipt functionality which respects user privacy during specific times. It also provides paper receipts whenever users prefer them.

Compliance from the consumer perspective

When you receive a receipt, it’s not just a proof of payment. It is part of a legal process. Behind the scenes, every compliant receipt is signed, archived and stored in ways that tax authorities accept. This protects you, too. If you need to return a product, request a warranty, or document an expense for tax or work reimbursement, a compliant receipt makes it easier.

fiskaltrust ensures that the receipts you get are traceable, tamper-proof and verifiable even if they’re fully digital. That means you don’t need to worry whether the receipt will be accepted or lost. It’s valid by design.

You may not care about fiscal regulations, but they affect you. If a merchant does not provide a compliant receipt, you may not be able to return your item or prove your purchase later. If you are self-employed, travelling, or need to show VAT for reimbursement, a non-compliant receipt can cost you time and money.

We are not a brand you buy from. You won’t see us at checkout. We work in the background to make sure the receipt you receive is trustworthy, legal and accessible without ever needing to create an account.

- The merchant uses fiskaltrust middleware to process transactions

- The receipt is signed and archived based on local tax laws

- A digital receipt is created instantly and linked to your payment

- You get the receipt via QR code, email, text, or download

- We do not track your behaviour or build marketing profiles

You can remain anonymous. If you choose to share contact info (like email or phone), we use it only to deliver your receipt. You can opt out or delete your data anytime.

Compliant receipts are like seatbelts—boring until you need them.

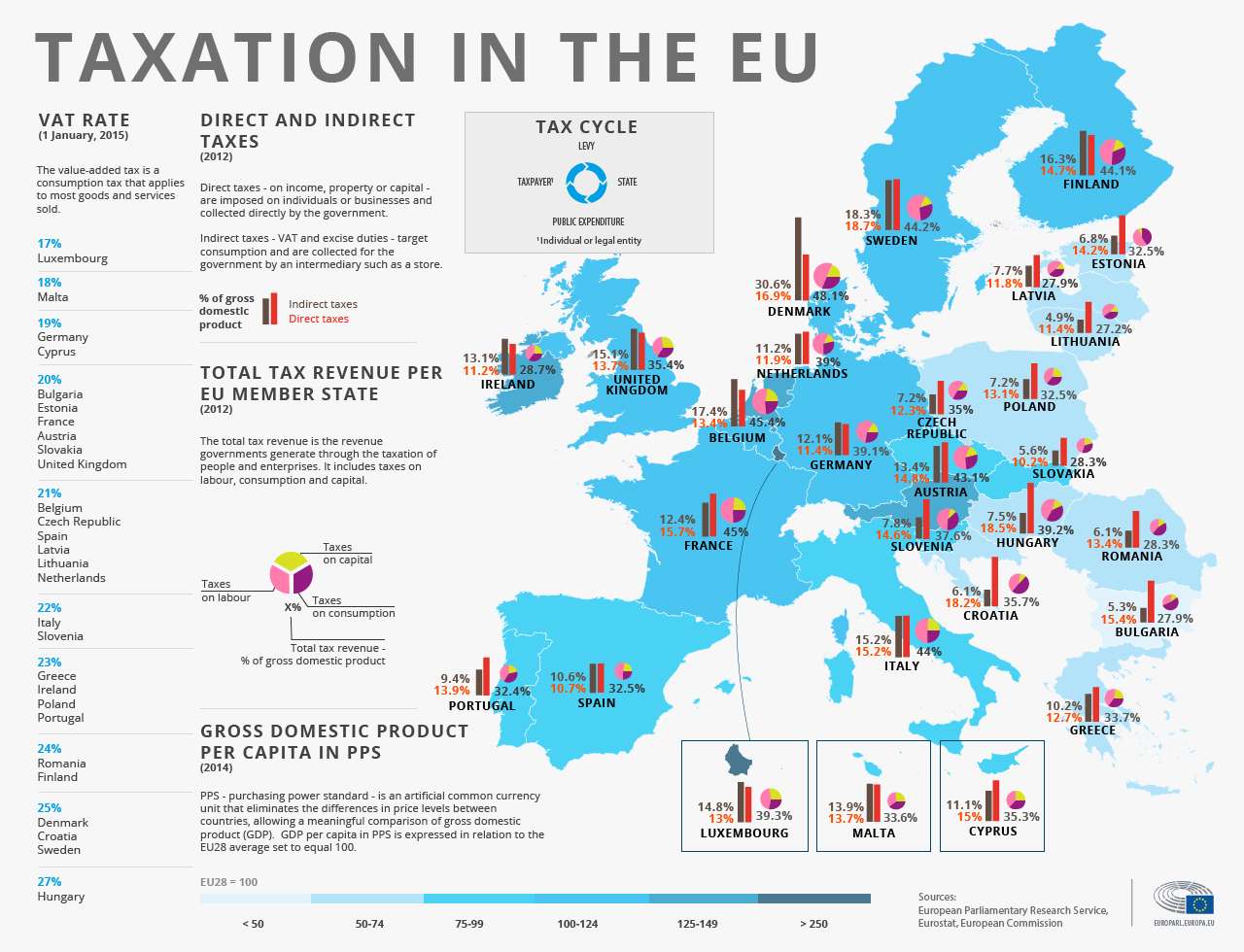

Why VAT Matters to You

The VAT amount becomes visible only when you examine the receipt in detail. The purchase of every item requires VAT payment and travelers and self-employed workers and foreign workers can request VAT reimbursement. The lack of compliant receipts will destroy all your potential claims for reimbursement. The importance of VAT exists beyond its role as state revenue collection. The amount you can get back through VAT recovery depends on your situation. The VAT information in fiskaltrust receipts follows national rules to ensure complete compliance. The proof you need for tax purposes and refund requests and reimbursement requests remains available to you.

Value-Added Tax (VAT) fraud significantly impacts Europe’s economy, leading to substantial revenue losses annually. To illustrate the extent of this issue, here are some key statistics

- Annual VAT Losses: In 2021, EU member states collectively lost approximately €61 billion in uncollected VAT.

- Notable Fraud Cases: In February 2025, Italian tax authorities accused Amazon of evading €1.2 billion in VAT payments related to sales of goods from non-EU countries between 2019 and 2021.

- Impact of Digital Measures: Member states that invested heavily in IT for their tax administrations between 2016 and 2019 experienced an 81% greater increase in VAT revenue compared to others. This is highlighting the effectiveness of digital tools in combating VAT fraud.

These figures underscore the importance of robust measures and technological investments to detect and prevent VAT fraud across Europe.

Want to know more?

Privacy