fiskaltrust.CloudCashBox

Fiscalization Made Easy—Anywhere, Anytime

fiskaltrust.CloudCashBox

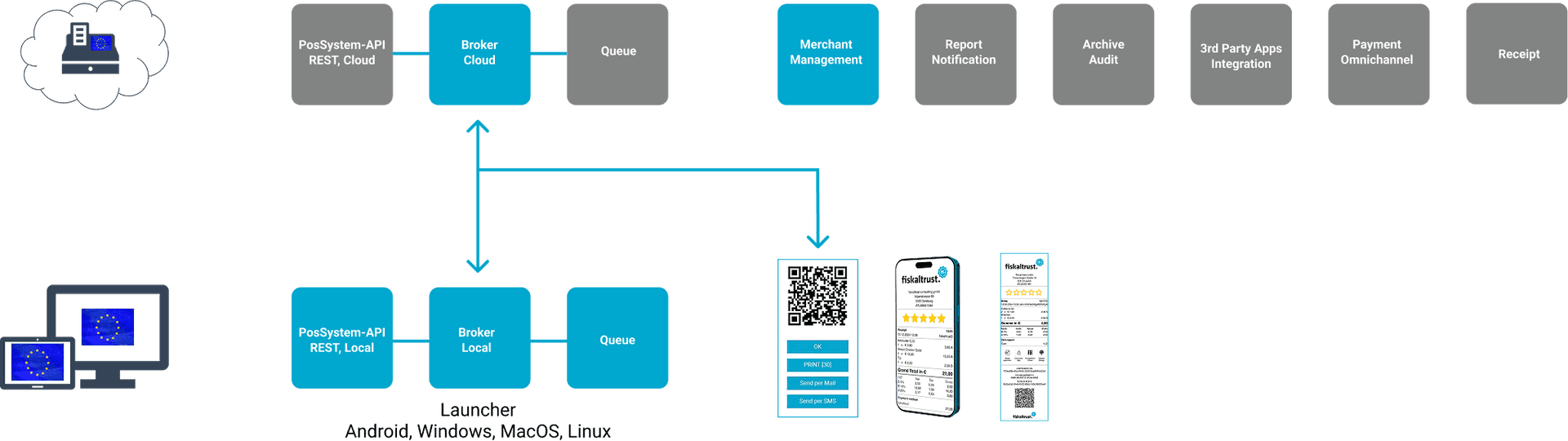

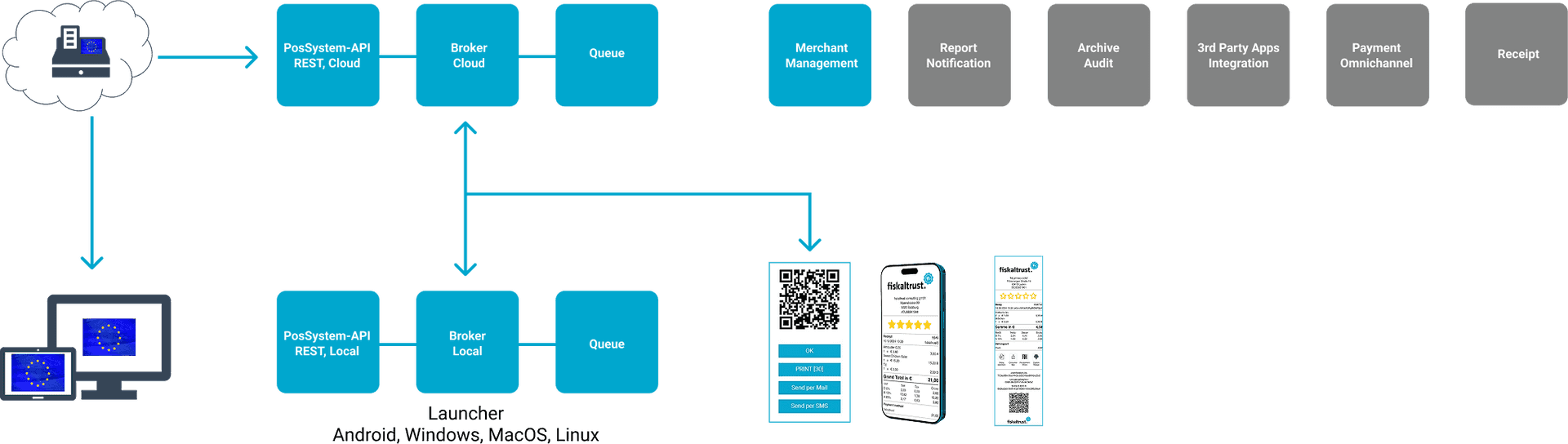

The fiskaltrust CashBox and CloudCashBox are advanced fiscalization solutions designed to ensure legal compliance and seamless transaction processing for businesses in regulated markets. Acting as a security layer, the CashBox integrates effortlessly with POS systems, locally or in the cloud, managing all necessary fiscalization tasks in real time.

Key Features

- Full Legal Compliance

- Seamless POS Integration

- Local & Cloud Options

- Automated Fiscalization

- High Security & Tamper-Resistance

- Cloud Monitoring & Maintenance

- Supports Multiple Signing Devices

Benefits

- Guaranteed Compliance

- Reduced IT Complexity

- Operational Efficiency

- Scalable & Flexible

- Future-Proof & Secure

- Remote Access & Monitoring

CashBox vs CloudCashBox

CashBox

The CashBox is a modular, locally installed fiscal unit that connects the POS system with fiscalization services. It processes, signs, and securely stores receipts in compliance with national regulations. Typically hosted on local hardware (e.g., POS terminal or server), it ensures offline capability and is ideal for environments requiring on-premise operation or hardware-based compliance components.

FreeOpen Source

- Local Hosting

Windows, Linux, Android, Mac, K8s - Local API

- Bring your own Signature Creation Device

- Advertisement optional

CloudCashBox

The CloudCashBox offers the same fiscal functions as the standard CashBox—but hosted entirely in the cloud. It provides real-time compliance, secure receipt processing, and remote data storage without requiring local infrastructure. It’s the preferred solution for cloud-based POS systems, multi-location retailers, and businesses seeking centralized control and minimal hardware dependency.

€ 74 / Year*Fair use

- Cloud Hosting

DE, FR, ES, IT, EU - Cloud API

- Signature Creation Service &

Burst Limit 30 receipts/min - 3-month digital receipt storage

Both solutions simplify compliance, minimize operational complexity, and provide businesses with a flexible, future-proof fiscalization strategy.

CashBox vs. CloudCashBox

| Aspect | CashBox (Local Middleware) | CloudCashBox (Cloud Middleware) |

|---|---|---|

| Hosting Location | On-premise: local PC, POS terminal, server, or embedded device | fiskaltrust-managed cloud (Microsoft Azure data center, region-specific) |

| Infrastructure Required | Requires installation, setup, and ongoing local maintenance | No local setup-provisioned and maintained by fiskaltrust |

| Offline Capability | Full offline operation (ideal for retail with unstable connectivity) | Online-first, with local fallback via loT broker when combined with hybrid |

| Scalability | Limited to local machine performance | Near-infinite scalability; ideal for multi-store or multi- |

| Setup Time | Manual install per device or via scripts | Instant provisioning via Portal/API tenant SaaS use |

| Security & Compliance | Local signing components (e.g. TSE, FT.Signature) may be required | Cloud-based compliance logic; TSE emulation or mirroring if supported |

| Data Storage | Stored locally, requires backups and maintenance | Revision-safe, hosted storage managed and secured by fiskaltrust |

| Audit Export Capability | Manual or automated exports from local journals | One-click audit export from cloud, always aligned with current laws |

| Updates & Regulation Sync | Manual updates or centralized rollout depending on setup | Automatic updates, including fiscal law changes |

| Hardware Requirements | May require fiscal printers, TSE modules, or local services | None-fully virtualized |

| Use Case Fit | Best for traditional retail or regulated markets with hardware mandates | Best for modern SaaS POS, marketplaces, or large multi-location retailers |

| Integration | POS API access to local service (via REST/RPC) | POS API access to cloud endpoint (REST) |

| Portal Monitoring | Limited if fully offline, enhanced if connected | Full monitoring via fiskaltrust.Portal |

| Cost Structure | Typically free (freemium) or hardware-bound licensing | Subscription-based (per location or volume) |

| Flexibility for Expansion | New store = new setup | New store = new API call |

Roles & Benefits

Partner

- No logistics, no inventory, no setup stress: Sell a digital product with zero hardware complexity

- Recurring revenue: Earn attractive margins via subscriptions rather than one-off hardware sales

- Simple onboarding: Onboard new customers quickly through the fiskaltrust.Portal

- Multi-country advantage: Offer the same CloudCashBox to customers in several EU markets

- Positioned for growth: Resell a scalable, regulation-proof solution that evolves with the market

Developer

- Integrate once, expand easily: No need to rewrite code for each new country

- Faster development, lower cost: Skip device provisioning and hardware dependencies

- Stay compliant without tracking laws: fiskaltrust handles regulation updates in the cloud

- Avoid lock-in: Open-source code means you’re in control

- DevOps-friendly: Spin up test environments instantly—ideal for agile teams and CI/CD

Merchant

- Compliance without complexity: No technical knowledge needed—everything handled in the cloud

- Zero maintenance: No local servers, no software installs, no manual updates

- Always audit-ready: Data is stored revision-safe and exports are legally formatted

- Flexible for every outlet: Works equally well for one store or one hundred

- Improves customer service: Digital receipts reduce refunds friction and support queries

Questions about integration? Our technical team is just a message away.

Contact Us