PosCreator Build Once, Comply Everywhere

Middleware for PosCreators

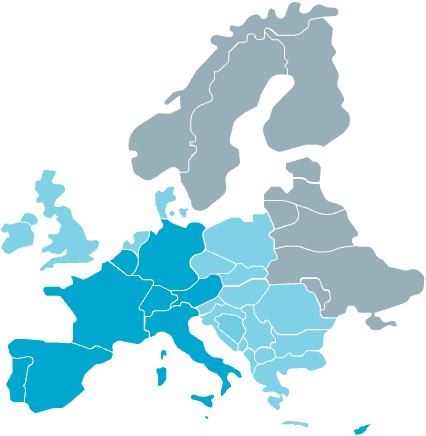

fiskaltrust.Middleware gives PosCreators a single integration point for fiscal compliance, digital receipts, and payments across multiple European markets. It is open-source, legally audited and designed to separate compliance logic from your POS code.

Focus on your product.

We handle the compliance.

- One POS-API for all markets

- Legally compliant signing, journaling, and archiving

- Fully auditable, open-source core

- Multi-hosting: local, cloud, or hybrid

- Revision-safe and regulation-ready

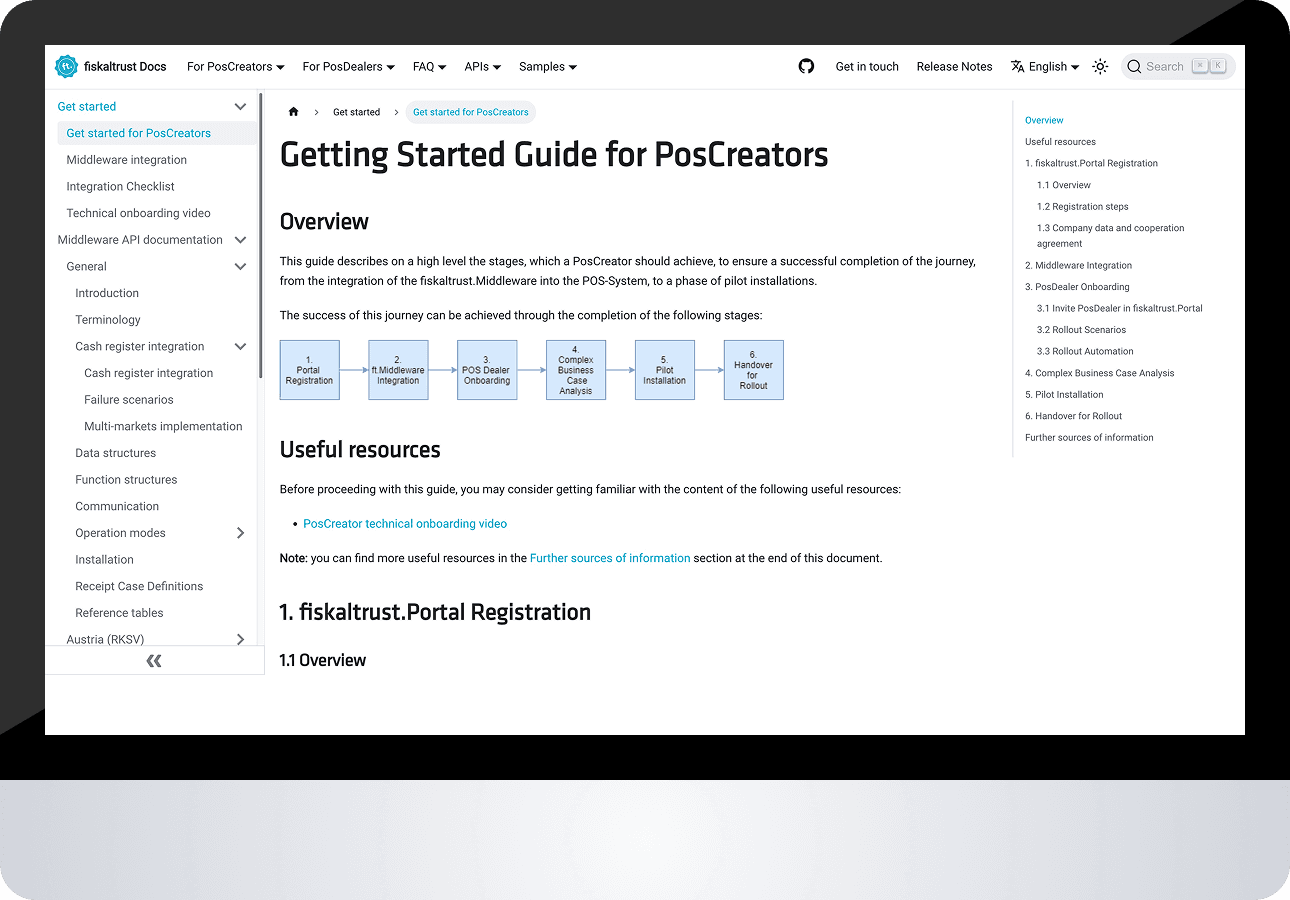

Open Source and Documentation Platform

fiskaltrust is transparent by design.

Our Middleware, POS-API definitions, and SDKs are fully open-source and available on GitHub.

Developers can access all technical documentation, examples, and onboarding guides at docs.fiskaltrust.cloud.

- Open MIT license – no vendor lock-in

- Full visibility of code and data flow

- GitHub examples and SDKs for major platforms

- Structured documentation and API references

- Sandbox and test environments

Integration

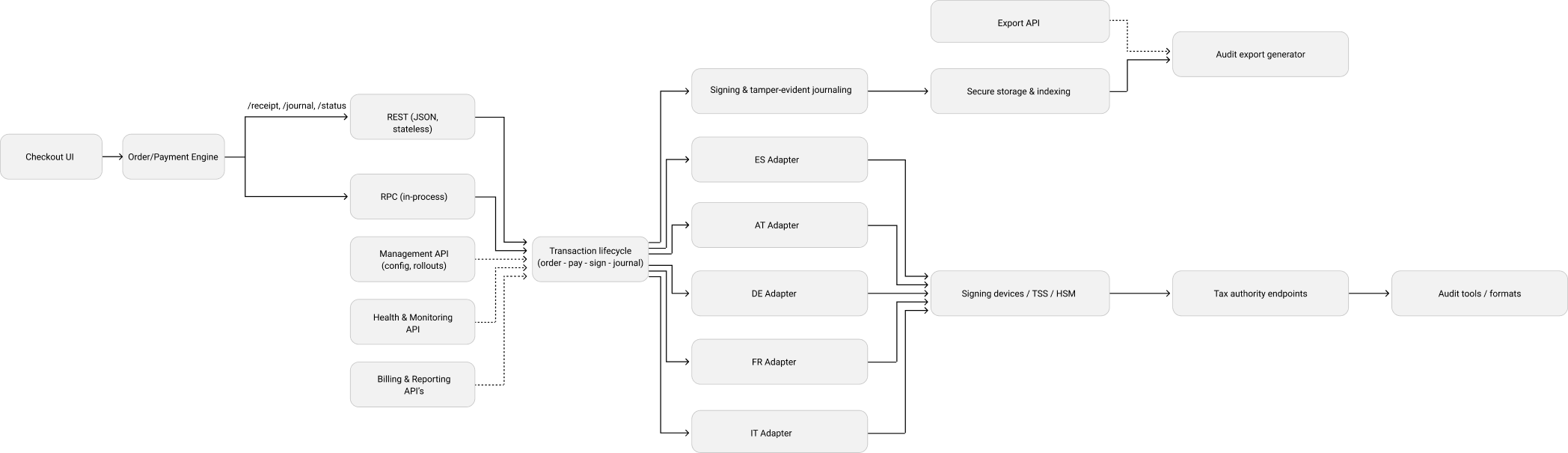

The fiskaltrust.POS-API abstracts away local fiscal differences. Whether you deploy on Windows, Android, or the cloud, you call the same endpoints

/echo for health check

/order for order processing

/pay for payment

/sign for fiscal sealing

/issue for receipt output

/journal for audit exports

- Future-proof architecture: One API, updated when laws change.

- Audit-ready data: Tamper-proof journals and export formats.

- Scalability: Works for one terminal or hundreds of stores.

- Speed: Standardised SDKs reduce integration time and maintenance.

- Reliability: Proven uptime and compliance in production environments across Europe.

- Community: Shared best practices and code examples through fiskaltrust.GitHub and Academy.

For developers, fiskaltrust offers a way to handle fiscal compliance across multiple countries through a single integration, removing the need to maintain separate solutions for each market. Our open-source architecture ensures full transparency, so you can review and trust the compliance logic you build on. Find out more about Integration partner benefits.

PosCreator Problem

The process of establishing fiscalization compliance for all markets requires both time and financial resources. Each country establishes its own distinct methods for data collection, storage and reporting systems which experience regular changes.

Maintaining custom compliance code for each jurisdiction is high risk, high cost, and slows your release cycle.

POS App

AT - Customs Complieance Code

+National Signing Logic

+Local Storage Format +Audit Export Script

DE - Customs Complieance Code

+National Signing Logic

+Local Storage Format +Audit Export Script

IT - Customs Complieance Code

+National Signing Logic

+Local Storage Format +Audit Export Script

FR - Customs Complieance Code

+National Signing Logic

+Local Storage Format +Audit Export Script

Solution Overview

With fiskaltrust you integrate our solution into your POS system once and stay compliant across all supported markets. The middleware operates as an automated system which performs all fiscalization operations from signing to journaling and secure data storage and audit export functions.

You focus on your POS features and we handle compliance complexity.

POS App

fiskaltrust Middleware

(Unified POS API)

AT Adapter

Automatic Legal Updates

Tamper-Evident Storage

DE Adapter

Automatic Legal Updates

Tamper-Evident Storage

IT Adapter

Automatic Legal Updates

Tamper-Evident Storage

FR Adapter

Automatic Legal Updates

Tamper-Evident Storage

Host locally, in your own datacentre, or in the fiskaltrust cloud. The interface stays identical.

Trusted by over 700 Integration Partners across Europe. Open-source code audited by the community and certified where required.

API Surface, at a glance

POS-API endpoints

/receipt, /journal, /status.

Management API

tenant, cashbox, certificates, device configuration.

Health & Monitoring API

component status, telemetry, incident hooks.

Export API

DSFinV-K, AT-DEP7 XML, FEC, and other national formats.

How to start

1.

Sign up in the fiskaltrust.Portal.

2.

Integrate via REST or RPC using our SDKs and open-source middleware.

3.

Deploy — compliant transactions from day one, in every supported country.

Quick Start

- Create a tenant and cashbox in the fiskaltrust.Portal.

- Point your POS to POS-API, REST or RPC.

- Send a test POST /receipt. Verify the signed response and journal entry.

- Enable the target country adapter and connect the signing device or trust service.

- Generate a sample audit export and run it through your QA checks.

Observability and Operations

- Health checks per cashbox, adapter, and signing device.

- Log correlation via transaction IDs and hash links.

- Alerting on signing failures, sequence violations, or export errors.

- Version tracking for adapters and legal content.´

Start in minutes. Stay compliant for years.

Questions about integration?

Our technical team is just a message away.

How fiskaltrust works – for Integrators

- Single Integration Point: Integrate your POS system once via the fiskaltrust.POS-API (REST for stateless cloud or RPC for in-process/desktop). No per-country API rewrites.

- Jurisdiction Abstraction: Country-specific compliance logic is encapsulated in adapters. The middleware routes transactions to the correct adapter based on the tenant’s registered market.

- Immutable Journaling: Every signed transaction is appended to an append-only, chained journal (hash-linked), stored either locally or in the cloud depending on configuration.

- Audit-Ready Export: Generates audit files in each market’s required format (e.g. DSFinV-K for DE, XML for AT, FEC for FR), on-demand or scheduled.

- Observability: Health & Monitoring API exposes status of connected cashboxes, signing devices, and legal processing pipelines.

- Transaction Lifecycle Enforcement: The middleware enforces a deterministic sequence — order → pay → sign → journal — ensuring idempotency and correct fiscal states.

- Cryptographic Signing: Integrates with certified signing devices, TSEs, or HSMs per national law. Creates non-repudiable, tamper-evident transaction signatures.

- Secure Data Storage: Supports both local revision-safe storage and cloud-based secure archiving, compliant with national retention periods.

- Automatic Legal Updates: Changes to fiscal rules are deployed centrally in the middleware/adapters — no POS code changes required.

- Management APIs: Configure tenants, cashboxes, certificates, and endpoint parameters without touching POS code.

Pricing

Free Tier:

Core API, open-source middleware, one country, community support.

Paid Plans

Multi-country, SLAs, extended logging, priority support.

Onboarding

Sign up for PosCreator role