Payment Service ProviderOne fiscalisation layer forpayments across Europe

Start with one integration, scale across markets. Stay compliant with every transaction.

With fiskaltrust, your PSP integration covers fiscal requirements in Austria, Germany, France, Italy and beyond.

Fiscalization Compliance Built Into Your Payment Flow

fiskaltrust connects payment flows with fiscal compliance. Our middleware ensures that every transaction processed through a PSP can be linked to a compliant, audit-proof receipt.

Payment at POS

POS sends payment request to PSP’s gateway.

Authorisation

PSP routes to card schemes or payment rails.

Banks approve/decline, PSP returns result to POS.

Fiscalisation

fiskaltrust generates a compliant receipt.

PSP transaction data (amount, method, ID) is tied to the fiscal journal.

Receipt Linking

A fiscal receipt ID connects PSP authorisation data with signed journal entries.

Reporting & Storage

Receipts are stored locally or in the cloud, and reported to tax authorities in real time or during audits.

Settlement

PSP settles funds to the merchant. Reports may include fiscal references for reconciliation.

Audit

Authorities check that every PSP transaction has a matching fiscalised receipt.

PSP’s Problem

PSPs already carry heavy compliance weight: PCI, PSD2, AML. On top of this, every fiscalised country adds its own technical rules for receipts, signatures, and reporting.

Each market forces you to build a custom integration, slowing merchant onboarding and inflating support costs. When tax rules change, your teams scramble with patches and updates. Compliance becomes another drag on margins.

AT

DE

FR

ES

PT

... and more

Solution Overview

fiskaltrust removes that fragmentation. Instead of country-by-country builds, you integrate once. Our middleware links fiscalisation directly to your payment events, creating compliant receipts, journals, and exports in every supported market.

Monitoring is built in. Legal changes flow through the platform automatically. You stay focused on scaling transactions, not untangling tax laws.

AT

DE

FR

ES

PT

... and more

Key benefits

- Faster merchant onboarding — no new country builds.

- Predictable audits with standardised exports.

- Lower SLA risk thanks to proactive monitoring.

- A single fiscalisation layer across Europe.

- New service revenue from fiscal add-ons.

Features

- One integration across markets.

- Transaction-level fiscalisation.

- Monitoring and alerts.

- Digital receipts included.

- Audit-ready exports.

- Partner enablement.

One integration, fiscalised payments across Europe with compliance built in.

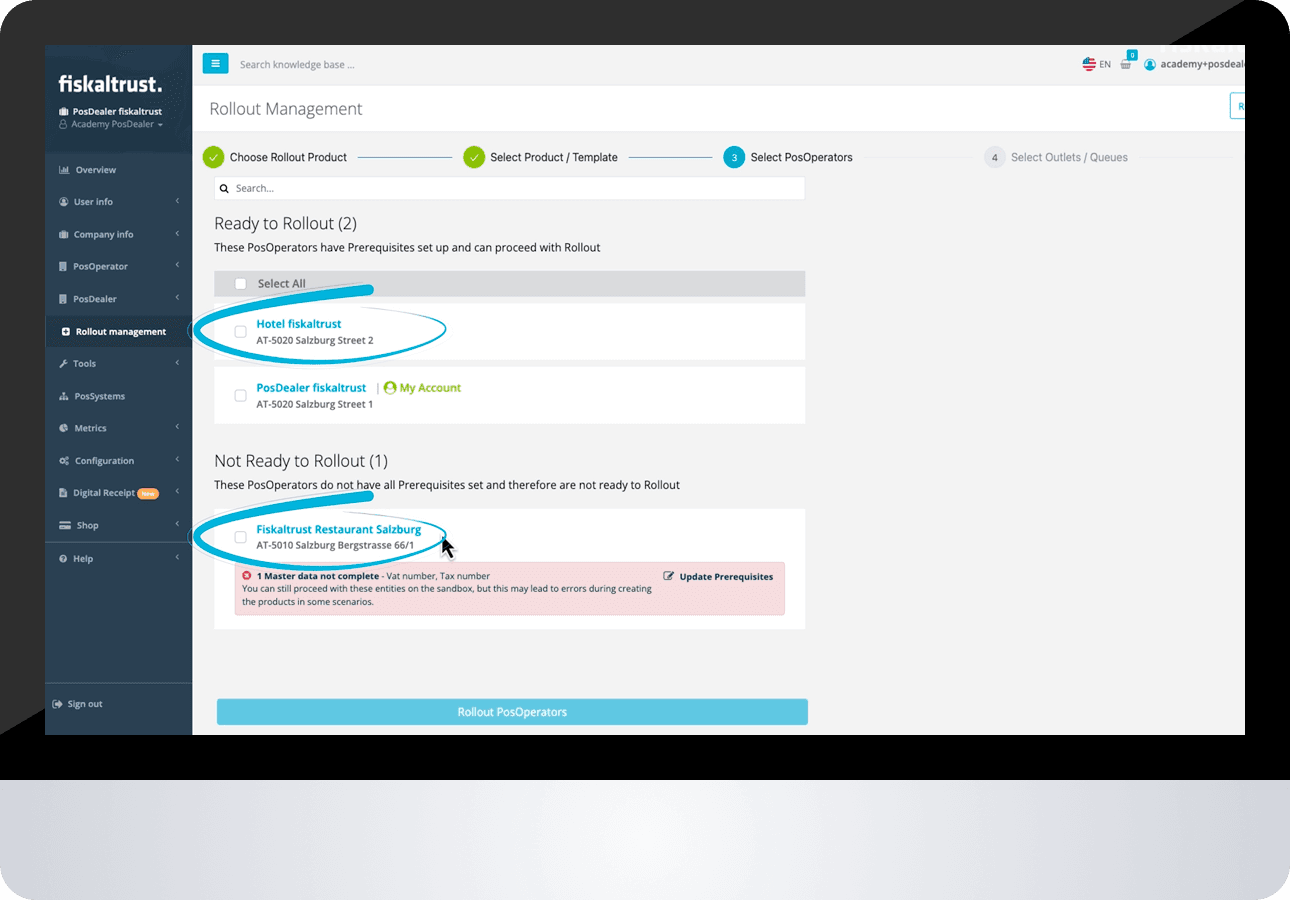

How to start

1.

Integration

Integrate once. Connect your PSP services via our APIs.

2.

Deployment

Deploy everywhere. Merchants roll out in fiscalised markets without extra country builds.

3.

Operation

Operate centrally. Use one monitoring environment for updates, exports, and compliance support.

Every day, fiskaltrust processes millions of fiscalised receipts across Europe. Our open-source middleware is actively maintained and regularly audited. Operations are ISO-aligned, and data handling is fully GDPR-compliant. PSP’s, POS vendors and merchants already rely on fiskaltrust as their trusted fiscalisation partner.

Explore: Bundles CloudCashBox, POSArchive, Notifications, InStoreApp, Digital Receipt, CloudCashBox.

ProductsAny questions about revenue share partnership?

Contact us